Commercial Battery Storage

The 2022 ATB represents cost and performance for battery storage across a range of durations (1–8 hours). It represents only lithium-ion batteries (LIBs)—with nickel manganese cobalt (NMC) and lithium iron phosphate (LFP) chemistries—at this time, with LFP becoming the primary chemistry for stationary storage starting in 2021. There are a variety of other commercial and emerging energy storage technologies; as costs are well characterized, they will be added to future editions of the ATB. There are a variety of other commercial and emerging energy storage technologies; as costs are well characterized, they will be added to future editions of the ATB.

The National Laboratory of the Rockies's (NLR's) Storage Futures Study examined energy storage costs broadly and specifically the cost and performance of LIBs (Augustine and Blair, 2021). The costs presented here (and on the distributed residential storage and utility-scale storage pages) are an updated version based on this work. This work incorporates base year battery costs and breakdowns from (Ramasamy et al., 2021), which works from a bottom-up cost model. The bottom-up battery energy storage systems (BESS) model accounts for major components, including the LIB pack, inverter, and the balance of system (BOS) needed for the installation. However, we note that during the elapsed time between the calculations for the Storage Futures Study and the ATB release, updated values have been calculated as more underlying data have been collected. Though these changes are small, we recommend using the data presented here in the ATB rather than those previously published with the Storage Futures Study.

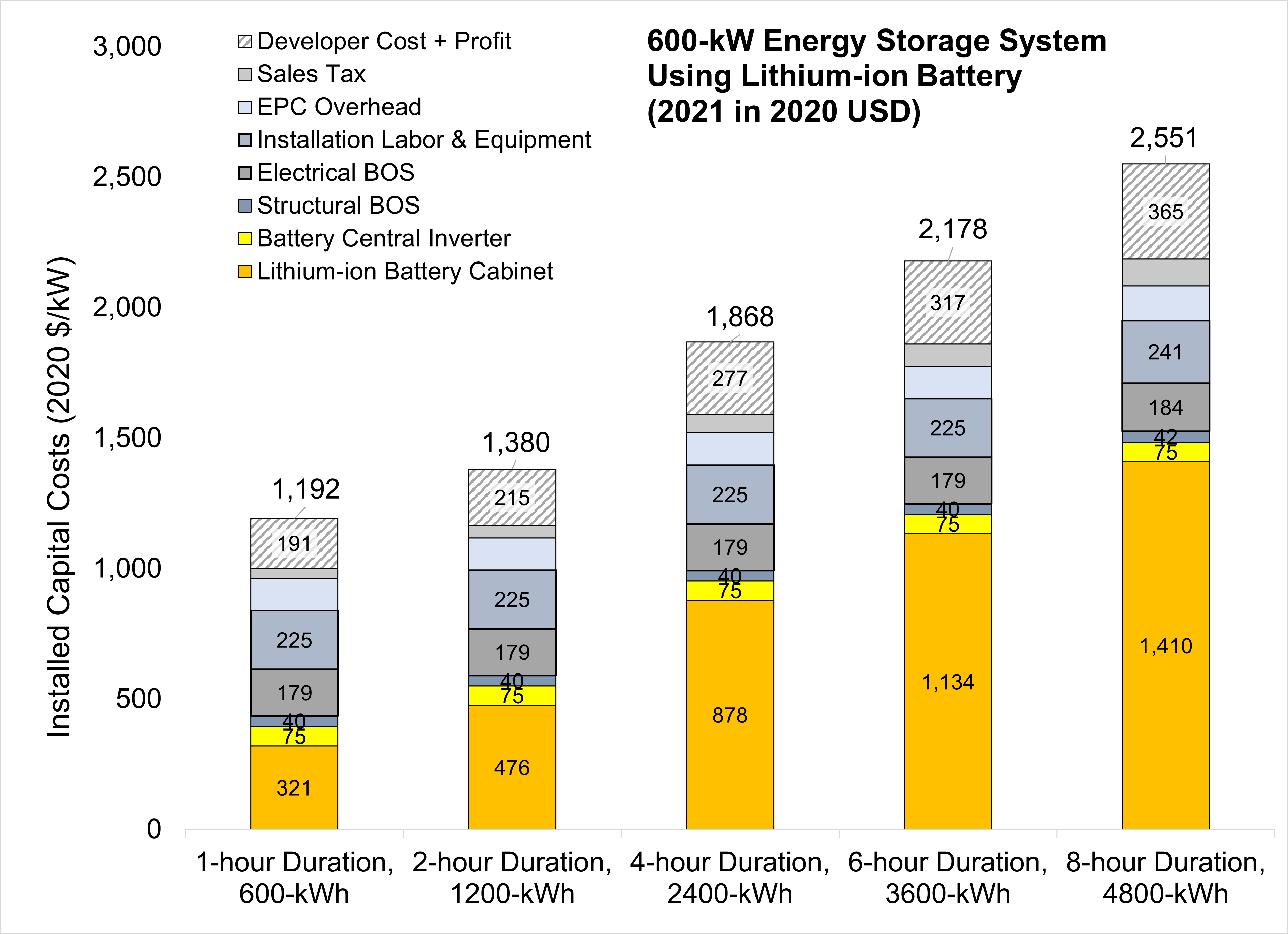

Base year costs for commercial and industrial BESS are based on NLR's bottom-up BESS cost model using the data and methodology of (Ramasamy et al., 2021), who estimated costs for a 600-kWDC stand-alone BESS with 0.5–4.0 hours of storage. We use the same model and methodology but do not restrict the power or energy capacity of the BESS. (Ramasamy et al., 2021). assumed an inverter/storage ratio of 1.67 based on guidance from (Denholm et al., 2017). We adopt this assumption, too.

Key modeling assumptions and inputs are shown in Table 1. Because we do not have battery costs that are specific to commercial and industrial BESS, we use the battery pack costs from (Ramasamy et al., 2021), which vary depending on the battery duration. These battery costs are close to our assumptions for battery pack costs for residential BESS at low storage durations and for utility-scale battery costs for utility-scale BESS at long durations. The underlying battery costs in (Ramasamy et al., 2021) come from (BNEF, 2019a) and should be consistent with battery cost assumptions for the residential and utility-scale markets.

| Model Component | Modeled Value | Description |

| System size | 60–1,200 kWDC power capacity 1-8 E/P ratio | Battery capacity is in kWDC. E/P is battery energy to power ratio and is synonymous with storage duration in hours. |

| LIB price | 1-hr: $211/kWh 2-hr: $168/kWh 4-hr: $165/kWh 6-hr: $144/kWh 8-hr: $135/kWh | Ex-factory gate (first buyer) prices (Ramasamy et al., 2021) |

| Inverter/storage ratio | 1.67 | Ratio of inverter power capacity to storage battery capacity (Denholm et al., 2017) |

| Battery central inverter price | $75/kW | Ex-factory gate (first buyer) prices |

We also consider the installation of commercial BESS systems at varying levels of duration (Figure 1). Costs come from NLR's bottom-up PV cost model (Ramasamy et al., 2021). As shown, the cost per kilowatt-hour reduces dramatically with additional levels of duration. Therefore, accurately estimating the needed duration in commercial applications is critical to determining the total system cost.

Scenario Descriptions

Available cost data and projections for distributed battery storage are very limited. Therefore, the battery cost and performance projections in the 2022 ATB are based on the same literature review as the utility-scale and residential battery cost projections. The projections are based on a literature review of 19 sources published in 2018 or 2019, as described by (Cole and Frazier, 2020). Three projections from 2020 to 2050 are developed for scenario modeling based on this literature.

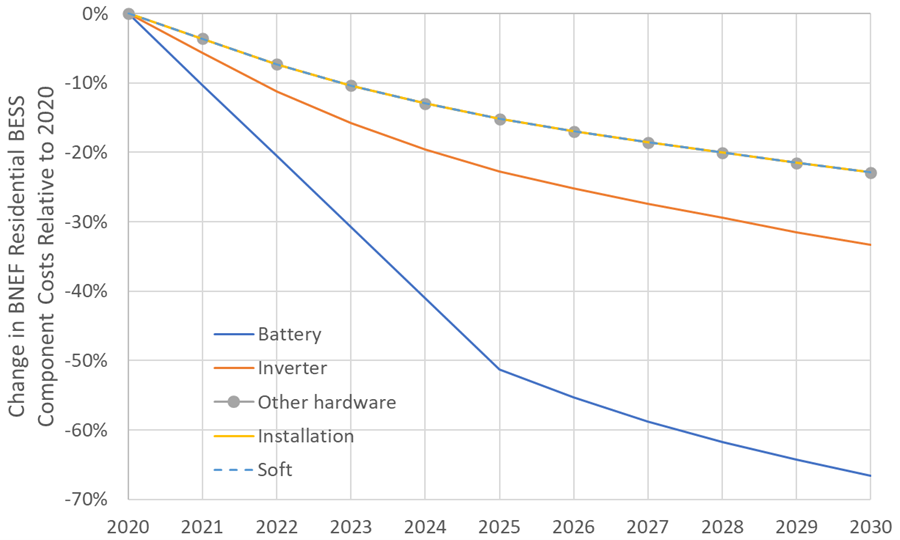

In all three of the scenarios described below, costs of battery storage are anticipated to continue to decline. The Storage Futures Study (Augustine and Blair, 2021) describes that the majority of this cost reduction comes from the battery pack cost component with minimal cost reductions in BOS, installation, and other components of the cost. The report indicates that NLR, BloombergNEF (BNEF), and others anticipate that the growth of the overall battery industry - across the consumer electronics sector, the transportation sector, and the electric utility sector - will lead to cost reductions. Additionally, BNEF and others indicate that changes in lithium-ion chemistry (such as switching away from cobalt) will also reduce cost. A third key factor is ongoing innovation with significant corporate and public research on batteries. Finally, the growth in the market (effective learning-by-doing) and more diversity of chemistries will expand and change the dynamics of the supply chain for batteries resulting in cheaper inputs to the battery pack (Mann et al., 2022).

- Conservative Technology Innovation Scenario (Conservative Scenario):The conservative projection is comprised of the maximum projection in 2020, 2025, and 2030 among the 19 cost projections from the literature review. Defining the 2050 points is more challenging because only four data sets extend to 2050; they show cost reductions of 19%, 25%, 27%, and 39% from 2030 to 2050. The 25% is used for the Moderate and Conservative scenarios. In other words, the Conservative Scenario is assumed to decline by 25% from 2030 to 2050.

- Moderate Technology Innovation Scenario (Moderate Scenario): The moderate projections are taken as the median point in 2020, 2025, and 2030 of the 19 projections reviewed. Defining the 2050 points is more challenging because only four data sets extend to 2050; they show cost reductions of 19%, 25%, 27%, and 39% from 2030 to 2050. The 25% is used for the Moderate and Conservative scenarios. In other words, the Moderate Scenario is assumed to decline by 25% from 2030 to 2050.

- Advanced Technology Innovation Scenario (Advanced Scenario): The advanced projections are taken as the lowest cost point in 2020, 2025, and 2030 of the 19 projections reviewed. Defining the 2050 points is more challenging because only four data sets extend to 2050; they show cost reductions of 19%, 25%, 27%, and 39% from 2030 to 2050. The 39% is used for the Advanced Scenario. In other words, the Advanced Scenario is assumed to decline by 39% from 2030 to 2050.

Methodology

Future cost projections for commercial and industrial BESS and PV+BESS are made using the same methodology as is used for residential BESS and PV+BESS. The normalized cost reduction projections for LIB packs used in residential BESS by (Mongird et al., 2020) are applied to future battery costs, and cost reductions for other BESS components use the same cost reduction potentials in Figure 2. Costs for commercial and industrial PV systems come from the 2022 ATB Moderate and Advanced Scenarios. We could not find projected costs for commercial and industrial BESS in the literature for comparison.

Data Source: (BNEF, 2019a)

Capital Expenditures (CAPEX)

Definition: The bottom-up cost model documented by (Ramasamy et al., 2021) contains detailed cost bins. Though the battery pack is a significant cost portion, it is not the majority of the cost of the battery system. This cost breakdown is different if the battery is part of a hybrid system with solar PV or a stand-alone system. These relative costs for commercial scale stand-alone battery are demonstrated in Table 2.

Current Year (2021): The Current Year (2021) cost breakdown is taken from (Ramasamy et al., 2021) and is in 2020 USD.

Within the ATB Data spreadsheet, costs are separated into energy and power cost estimates, which allows capital costs to be constructed for durations other than 4 hours according to the following equation:

Total System Cost ($/kW) = (Battery Pack Cost ($/kWh) × Storage Duration (kWh) + Battery Power Capacity (kW) × BOS Cost ($/kW) + Battery Power Constant ($)) / Battery Power Capacity (kW)

For more information about the power versus energy cost breakdown, see (Cole and Frazier, 2020). For items included in CAPEX, see the table below.

Future Projections: Future projections are based on the same literature review data that inform (Cole and Frazier, 2020), which generally used the median of published cost estimates to develop a Mid Technology Cost Scenario and the minimum values to develop a Low Technology Cost Scenario. However, as the battery pack cost is anticipated to fall more quickly than the other cost components (which is similar to the recent history of PV system costs), the battery pack cost reduction is taken from (BNEF, 2019b)(Frith, 2020) and is reduced more quickly. This tends to make the longer-duration batteries (e.g., 8 hours) decrease more quickly while shorter-duration batteries (e.g., 2 hours) decrease less quickly into the future. All durations trend toward a common trajectory as battery pack costs decrease into the future.

Operation and Maintenance (O&M) Costs

Base Year: (Cole et al., 2021) assume no variable O&M (VOM) costs . All operating costs are instead represented using fixed O&M (FOM) costs. The fixed O&M costs include battery replacement costs, based on assumed battery degradation rates that drive the need for 20% capacity augmentations after 10 and 20 years to return the system to its nameplate capacity (Ramasamy et al., 2021). The augmentations assume that 20% of the cells are replaced in each augmentation, with costs for battery cells and bidirectional inverters dropping 40% in the next 20 years. In the 2022 ATB, FOM is defined as the value needed to compensate for degradation to enable the battery system to have a constant capacity throughout its life. According to the literature review (Cole et al., 2021), FOM costs are estimated at 2.5% of the capital costs in dollars per kilowatt. Items included in O&M are shown in the table below.

Future Years: In the 2022 ATB, the FOM costs and the VOM costs remain constant at the values listed above for all scenarios.

Capacity Factor

The cost and performance of the battery systems are based on an assumption of approximately one cycle per day. Therefore, a 4-hour device has an expected capacity factor of 16.7% (4/24 = 0.167), and a 2-hour device has an expected capacity factor of 8.3% (2/24 = 0.083). Degradation is a function of this usage rate of the model and systems might need to be replaced at some point during the analysis period. We use the capacity factor for a 4-hour device as the default value for ATB.

Round-Trip Efficiency

Round-trip efficiency is the ratio of useful energy output to useful energy input. (Mongird et al., 2020) identified 86% as a representative round-trip efficiency, and the 2022 ATB adopts this value. In the same report, testing showed 83-87%, literature range of 77-98%, and a projected increase to 88% in 2030.

References

The following references are specific to this page; for all references in this ATB, see References.