Commercial Battery Storage

The battery storage technologies do not calculate LCOE or LCOS, so do not use financial assumptions. Therefore all parameters are the same for the R&D and Markets & Policies Financials cases.

The 2023 ATB represents cost and performance for battery storage across a range of durations (1–8 hours). It represents only lithium-ion batteries (LIBs) - those with nickel manganese cobalt (NMC) and lithium iron phosphate (LFP) chemistries - at this time, with LFP becoming the primary chemistry for stationary storage starting in 2021. There are a variety of other commercial and emerging energy storage technologies; as costs are characterized to the same degree as LIBs, they will be added to future editions of the ATB.

The National Laboratory of the Rockies's (NLR's) Storage Futures Study examined energy storage costs broadly and specifically the cost and performance of LIBs (Augustine and Blair, 2021). The costs presented here (and on the distributed residential storage and utility-scale storage pages) are an updated version based on this work. This work incorporates base year battery costs and breakdowns from (Ramasamy et al., 2022), which works from a bottom-up cost model. The bottom-up battery energy storage systems (BESS) model accounts for major components, including the LIB pack, inverter, and the balance of system (BOS) needed for the installation. However, we note that during the time elapsed between the calculations for the Storage Futures Study and the ATB release, updated values were calculated as more underlying data were collected. Though these changes are small, we recommend using the ATB data rather than those published with the Storage Futures Study.

Base year costs for commercial and industrial BESS are based on NLR's bottom-up BESS cost model using the data and methodology of (Ramasamy et al., 2022), who estimated costs for a 300-kWDC stand-alone BESS with four hours of storage. We use the same model and methodology, but we do not restrict the power or energy capacity of the BESS. (Ramasamy et al., 2022) assumed an inverter/storage ratio of 1.67 based on guidance from (Denholm et al., 2017). We adopt this assumption, too.

Key modeling assumptions and inputs are shown in Table 1. Because we do not have battery costs that are specific to commercial and industrial BESS, we use the battery pack costs from (Ramasamy et al., 2022), which vary depending on the battery duration. These battery costs are close to our assumptions for battery pack costs for residential BESS at low storage durations and for utility-scale battery costs for utility-scale BESS at long durations. The underlying battery costs in (Ramasamy et al., 2022) come from (BNEF, 2019a) and should be consistent with battery cost assumptions for the residential and utility-scale markets.

| Model Component | Modeled Value | Description |

| System size | 100–2,000 kWDC power capacity 1-8 E/P ratio | Battery capacity is in kWDC. E/P is battery energy to power ratio and is synonymous with storage duration in hours. |

| LIB price | 1-hr: $211/kWh 2-hr: $215/kWh 4-hr: $199/kWh 6-hr: $174/kWh 8-hr: $164/kWh | Ex-factory gate (first buyer) prices (Ramasamy et al., 2022) |

| Inverter/storage ratio | 1.67 | Ratio of inverter power capacity to storage battery capacity (Denholm et al., 2017) |

| Battery central inverter price | $97.5/kWDC | Ex-factory gate (first buyer) prices |

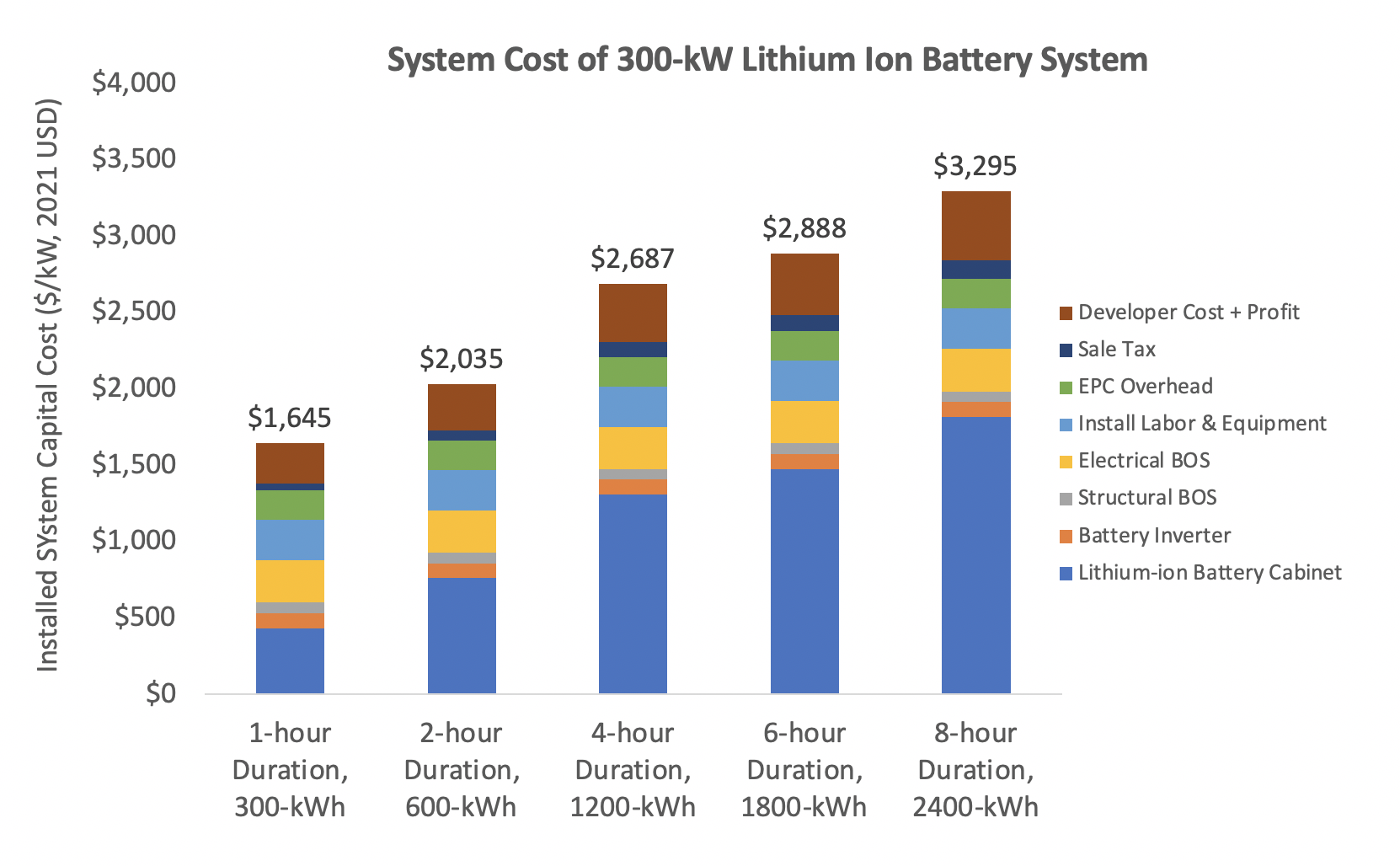

We also consider the installation of commercial BESS systems at varying levels of duration (Figure 1). Costs come from NLR's bottom-up PV cost model (Ramasamy et al., 2022). As shown, the cost per kilowatt-hour is lowered dramatically with additional duration. Therefore, accurately estimating the needed duration in commercial applications is critical to determining the total system cost.

Scenario Descriptions

Available cost data and projections for distributed battery storage are very limited. Therefore, the battery cost and performance projections in the 2023 ATB are based on the same literature review as that done for the utility-scale and residential battery cost projections: battery cost and performance projections in the 2023 ATB are based on a literature review of 14 sources published in 2021 or 2022, as described by Cole and Karmakar (Cole and Karmakar, 2023). Three projections for 2022 to 2050 are developed for scenario modeling based on this literature.

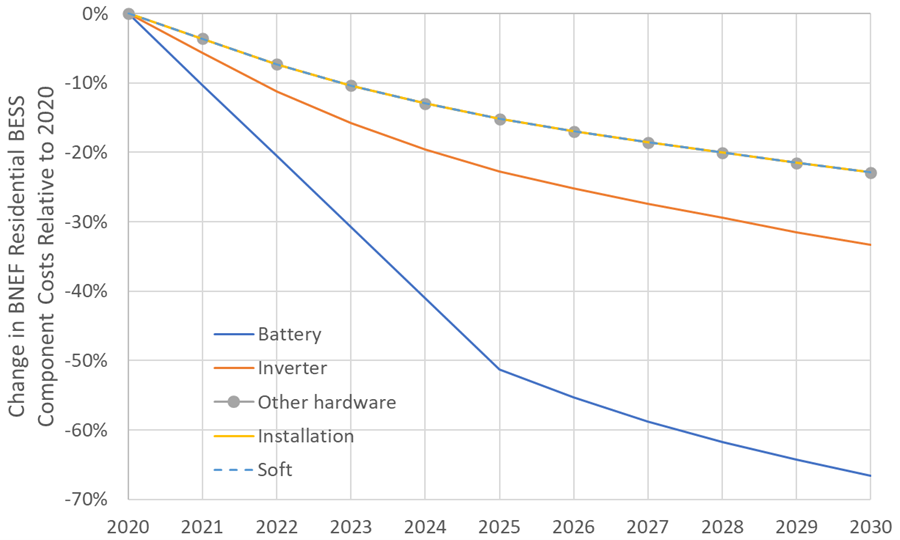

In all three of the scenarios described below, costs of battery storage are anticipated to continue to decline in future years. The Storage Futures Study (Augustine and Blair, 2021) describes that most of this cost reduction comes from the battery pack cost component, with minimal cost reductions in BOS, installation, and other contributors to the total cost. The Storage Futures Study report (Augustine and Blair, 2021) indicates that NLR, BloombergNEF (BNEF), and others anticipate the growth of the overall battery industry - across the consumer electronics sector, the transportation sector, and the electric utility sector - will lead to cost reductions. Additionally, BNEF and others indicate that changes in lithium-ion chemistry (e.g., switching from cobalt) will also reduce overall cost. A third key factor is ongoing innovation through significant corporate and public research on batteries. Finally, the growth in the market (effective learning-by-doing) and increased diversity of chemistries will expand and change the dynamics of the supply chain for batteries, resulting in cheaper inputs to the battery pack (Mann et al., 2022).

The three scenarios for technology innovation are:

- Conservative Technology Innovation Scenario (Conservative Scenario):The conservative projection consists of the maximum projection in 2022, 2023, 2024, 2025, and 2030 among the 14 cost projections from the literature review (Cole and Karmakar, 2023). Defining the points in 2050 is more challenging because the projections with the least cost reduction only extend to 2030. The projection with the smallest relative cost decline after 2030 showed battery cost reductions of 5.8% from 2030 to 2050. This 5.8% is used from the 2030 point in defining the conservative cost projection. In other words, the battery costs in the Conservative Scenario are assumed to decline by 5.8% from 2030 to 2050.

- Moderate Technology Innovation Scenario (Moderate Scenario): The moderate projections are taken as the median point in 2022, 2023, 2024, 2025, 2030, and 2050 from the 14 projections reviewed. The projections that are consistent with the median in 2030 do extend through 2050, which is why the median projection is used for 2050.

- Advanced Technology Innovation Scenario (Advanced Scenario): The advanced projections are taken as the lowest cost point in 2022, 2023, 2024, 2025, 2030, and 2050 from the 14 projections reviewed. The lowest cost projections also extend through 2050, allowing the lowest cost projection to be used for 2050.

Scenario Assumptions

Scenario assumptions for commercial and industrial BESS were derived using a literature review, and are not based on learning curves or deployment projections.

For a 600kW 4-hour battery, the technology-innovation scenarios for commercial-scale BESS described above result in CAPEX reductions of 17% (Conservative Scenario), 36% (Moderate Scenario), and 52% (Advanced Scenario) between 2022 and 2035. The average annual reduction rates are 1.4% (Conservative Scenario), 2.8% (Moderate Scenario), and 4.0% (Advanced Scenario).

Between 2035 and 2050, the CAPEX reductions are 4% (0.3% per year average) for the Conservative Scenario, 20% (1.3% per year average) for the Moderate Scenario, and 31% (2.1% per year average) for the Advanced Scenario.

Methodology

Future cost projections for commercial and industrial BESS and PV+BESS are made using the same methodology as is used for residential BESS. The normalized cost reduction projections for LIB packs used in residential BESS by Mongird et al (Mongird et al., 2020) are applied to future battery costs, and cost reductions for other BESS components use the same cost reduction potentials in Figure 2. Costs for commercial and industrial PV systems come from the 2023 ATB Moderate and Advanced scenarios. We could not find projected costs for commercial and industrial BESS in the literature for comparison.

Data Source: (BNEF, 2019a)

Capital Expenditures (CAPEX)

Definition: The bottom-up cost model documented by Ramasamy (Ramasamy et al., 2022) contains detailed cost bins. Though the battery pack is a significant cost portion, it is not the majority of the cost of the battery system. This cost breakdown is different if the battery is part of a hybrid system with solar PV or a stand-alone system. These costs for commercial scale stand-alone battery are demonstrated in Figure 3.

Current Year (2022): The Current Year (2022) cost breakdown is taken from (Ramasamy et al., 2022) and is in 2021 USD.

Within the ATB Data spreadsheet, costs are separated into energy and power cost estimates, which allows capital costs to be constructed for durations other than 4 hours according to the following equation:

$$\text{Total System Cost (\$/kW)} = \bigg[ \text{Battery Pack Cost (\$/kWh)} \times \text{Battery Energy Capacity (kWh)} \; +$$

$$ \text{Battery Power Capacity (kW)}\times \text{BOS Cost (\$/kW)} \; +$$

$$\text{Battery Power Constant (\$)} \bigg] / \; \text{Battery Power Capacity (kW)}$$

For more information about the power versus energy cost breakdown, see Cole and Frazier (Cole and Frazier, 2020). For items included in CAPEX, see Table 2 below.

Future Projections: Future projections are based on the same literature review data that inform Cole and Frazier (Cole and Frazier, 2020), who generally used the median of published cost estimates to develop a Mid Technology Cost Scenario and the minimum values to develop a Low Technology Cost Scenario. However, as the battery pack cost is anticipated to fall more quickly than the other cost components (which is similar to the recent history of PV system costs), the battery pack cost reduction is taken from (BNEF, 2019b) and (BNEF, 2020), and it is reduced more quickly. This tends to make the longer-duration batteries (e.g., 8 hours) decrease more quickly and shorter-duration batteries (e.g., 2 hours) decrease less quickly into the future. All durations trend toward a common trajectory as battery pack costs decrease into the future.

Operation and Maintenance (O&M) Costs

Base Year: (Cole and Karmakar, 2023) assume no variable O&M (VOM) costs . All operating costs are instead represented using fixed O&M (FOM) costs. In the 2023 ATB, FOM is defined as the value needed to compensate for degradation to enable the battery system to operate at its rated capacity throughout throughout its 15-year lifetime. FOM costs are estimated at 2.5% of the capital costs in $/kW. Items included in O&M are shown in Table 3.

Future Years: In the 2023 ATB, the FOM costs and the VOM costs remain constant at the values listed above for all scenarios.

Capacity Factor

The cost and performance of the battery systems are based on an assumption of approximately one cycle per day. Therefore, a 4-hour device has an expected capacity factor of 16.7% (4/24 = 0.167), and a 2-hour device has an expected capacity factor of 8.3% (2/24 = 0.083). Degradation is a function of this usage rate of the model, and systems might need to be replaced at some point during the analysis period. We use the capacity factor for a 4-hour device as the default value for ATB.

Round-Trip Efficiency

Round-trip efficiency is the ratio of useful energy output to useful energy input. (Cole and Karmakar, 2023) identified 85% as a representative round-trip efficiency, and the 2023 ATB adopts this value.

References

The following references are specific to this page; for all references in this ATB, see References.