Financial Cases and Methods

Financial assumptions impact the levelized cost of energy (LCOE) by changing the cost of capital needed to finance electricity generation projects. The equations and variables used to estimate LCOE are defined on the Equations and Variables page.

This section of the ATB focuses on the input variables to the weighted average cost of capital (WACC), which is used in the ATB as the discount rate input to the capital recovery factor for the LCOE formula. The capital recovery factor and the project finance factor determine the fixed charge rate, which incorporates other elements of project finance including the:

- Combined federal and state tax rate

- Depreciation schedule of the asset

- Average inflation rate

- Tax incentives.

Because the elements mentioned above are fixed or would require changes to legislation, the discussion on this page focuses on the variables in WACC.

Financial Assumptions Cases

Two different cases with differing project finance assumptions are used within the ATB:

- Financing structure without tax incentives based on long-term averages: LCOE improvement is therefore based on R&D improvements alone (R&D Only Case).

- Market + Policies Financial Assumptions Case, in which there are market and policy changes (Market + Policies Case).

Use the following chart to explore the differences between the two financial assumptions cases.

To explore the effect of financial assumptions on LCOE, select a technology and financial assumptions case.

To explore the financial assumptions, select a financial parameter (interest rate, rate of return, capital recovery factor, debt fraction, and WACC), technology, and financial assumptions case.

The R&D Only Case, the Market + Policies Case, and the methodology and assumptions are as follows:

- R&D Only Case

- Estimates technology-specific debt interest rates, return on equity rates, and debt fraction to reflect technological risk perception but with consistent assumptions around sources of capital and ownership across technologies (i.e., independent power producer, financed with a tax equity partnership)

- Holds tax and inflation rates constant at assumed long-term values: 21% federal tax rate, 6% state tax rate (though actual state tax rates vary), and 2.5% inflation rate

- Excludes effects of tax credits

- Market + Policies Case

- Retains the technology-specific return on equity rates developed in the R&D Only Case

- Modifies the average the inflation rate over the life of the project to account for recent inflation

- Applies federal tax credits and expires them as consistent with existing law and guidelines

- General Methodology and Assumptions

- Renewable Generators: Projects with financing terms are owned by independent power producers (IPPs) that have entered into long-term, fixed-price, take-or-pay power purchase agreements (PPAs) for the sale of the electricity. Though PPAs are not the only possible arrangement, they are the dominant form of asset ownership and electricity offtake for new renewable energy assets in the United States.

- Financing Structure: New to the 2023 ATB, financial structures for IPP-owned projects are assumed to use a tax equity partnership and debt. Tax equity arrangements are currently a popular financing technique, and they generally offer lower-cost equity than sponsor equity, for a portion of the cost project costs in exchange for the associated tax benefits, as not all companies can use all the tax benefits.

- Conventional Generators: Natural gas plants represent most of all recently installed conventional electricity generation, and they therefore represent "typical" financial transactions and financing terms. Financing terms reflect natural gas electric generation projects also owned by IPPs that sell power through either a short-term contract or a wholesale spot electricity market, which are otherwise known as quasi-merchant projects. Natural gas plants in unregulated markets have not historically entered electricity price contracts of the same length as renewable energy generation assets for a variety of reasons, including the challenges of fuel price hedging or contracting for more than a few years.

- Risk Assessment: Financial assumptions reflect the different terms offered by financiers to projects with varying levels of risk. Although we recognize that in practice these risks may also be reflected in capital expenditures (CAPEX), in soft costs, in a contingency fund, or elsewhere, we believe reflecting risk in the financing terms provides the clearest and most consistent approach. Therefore, we use technology-specific debt interest rates, returns on equity, and debt fractions as a percentage of the total project to reflect technological risk perception. Debt fraction is calculated using a separate financial model, with technology-specific ATB inputs, based on technology-specific assumed debt service coverage ratios (DSCRs).

- Domestic Focus: Assumptions primarily reflect technology risk within the U.S. market, but some consideration is given to international development. An individual technology may receive more-favorable financing terms outside the United States as a result of different macroeconomic factors (e.g., different regulations or different interest rates), more government interventions or more market guarantees, or better market perception of technologies.

- Constant Technology Risk: Assumptions reflect no change in underlying risk perception for all technologies over time. The modeled renewable technologies have globally deployed billions of dollars in CAPEX and currently receive more-favorable financing terms than other electric generation technologies. Though there is still opportunity for further risk perception reduction, because the cost of capital is so favorable, we assume a reduction in risk would likely result in higher leverage, providing equity investors with higher returns (which might have a neutral impact on the overall cost of capital) or electricity offtake agreements that are currently considered riskier than long-term PPAs (i.e., selling electricity into wholesale markets). It should be noted that even if the reduction of risk does not lower cost, it could increase adoption by opening more markets and opportunities. At the same time, the differences in risk between technologies reflect underlying technology risks of construction and operation.

- Cost Recovery Period: Both cases assume a constant cost recovery period—or period over which the initial capital investment is recovered—of 30 years for all technologies. The ATB also provides an option to look at cost recovery over a 20-year period, and a "tech life" period where the lifetime varies by technology.

Methods for Developing Financial Assumptions

This approach to generating the financial assumptions includes technology-specific financial assumptions to (1) capture more granularity of current and future energy markets and (2) show changes in financing rates that are attributable to the reduction or elimination of tax credits for eligible technologies (see below for schedule reductions). Each technology has its own specific risk factors that might influence the underlying cost of financing. However, a multitude of other factors determine a project's cash flow risk, including:

- Political risk

- Regulatory uncertainty

- Project development risk (i.e., risks associated with project cost overruns, behind schedule, or not completed at all)

- Government support (if any)

- Ownership risk, including creditworthiness (IPP versus investor-owned utility versus public utility)

- Creditworthiness of the electricity offtaker and the length of the contract (if any)

- Whether the electricity price is firm or changes with the market

- Supply and demand of competing electricity and sources of financing (plants with electricity contracts can still be exposed to supply and demand risk if financing is at all tied to value after the end of a contract or any risks associated with curtailment)

- Underlying inflation rate, and the cost of the base rate (e.g., London Inter-Bank Offered Rate, or LIBOR).

Also, some projects might receive more-favorable financing because of the economies of scale of closing a financial transaction (e.g., it does not take twice the effort to perform financial due diligence on a project that is twice the price). There are also a wider pool of investors with larger projects as some investors have minimum investment thresholds. For these reasons, there is a wide range in financing costs across the United States, and the world, even for the same technology. Long-term PPAs used by renewable energy projects avoid many of the financial risks associated with electricity offtake and price uncertainty. Financing terms for conventional energy generation reflect natural gas electric generation projects owned by IPPs that sell power through short-term contracts or through a wholesale spot electricity market—otherwise known as quasi-merchant projects.

We collect data from a variety of sources that have exposure to different renewable energy technology financings, both in the United States and abroad. In doing so, we try to accurately represent typical financing costs for each technology as well as the differences, if any, between technologies. We collect data points for the:

- After-tax cost of levered equity during the construction and operation of the asset

- Cost of debt during the construction and operation of the asset

- Amount of debt provided during construction

- Required DSCR debt providers use to determine the amount of debt (i.e., leverage) they would provide a project during the operation of the asset.

In the 2020 ATB through the 2023 ATB—unlike the 2019 ATB and earlier editions—we add the cost of equity during construction. We make this change for two reasons:

- Construction debt providers almost always require a certain percentage of construction costs (typically the first dollars spent) to come from equity providers

- We hope to differentiate the cost of construction financing from the cost of financing during operations.

In particular, in ATB editions before 2020, the cost of equity for geothermal plants was assumed to be much higher than other technologies to account for the risks during construction. By separating these two financing periods, we can lower the cost of equity for a geothermal plant during operation to bring it more in-line with real-world financing terms.

Based on recent increases in the cost of capital (Norton Rose Fulbright, 2023), the 2023 ATB increases the nominal cost of equity by 1% for all technologies relative to prior years. Documentation for differences in the cost of equity can be found in (Feldman et al., 2020) or in prior editions of the ATB.

Based on industry interviews, we include a 2% premium on the cost of equity during construction for each project—with the exception of geothermal, coal, and natural gas projects—relative to the cost of equity during plant operation, to account for construction risk. Coal and natural gas do not assume a construction cost premium, but they have a leverage rate of 55%, consistent with the assumptions in (Theis, 2021). Additionally, we separate the cost of equity during construction for geothermal into two stages: predrilling (assumed to be 15%) and post-drilling (with assumed site control in place, permitting completed, and a PPA contracted), with no premium on the cost of equity relative to the cost of equity during plant operation.

For interest rates, we assume a 300 basis point spread relative to the 10-year treasury yield (U.S. Department of the Treasury, 2023), which at the time of data entry was at 3.9% and resulted in interest rates of 7% for most technologies. We maintain the 1% relative increase in interest rates for technologies such as natural gas from (Feldman et al., 2020). These rates are a 300 basis point increase from our previous interest rates, which matches the increase in the 10-year treasury yield since the 2022 ATB. These rates are expected to persist through the end of the Congressional Budget Office's forecast window, so we adopt them for the entire ATB time series (CBO, 2023).

According to Norton Rose Fulbright (Norton Rose Fulbright, 2023), interest during construction is approximately 0.5% lower than term debt, which we implement for all technologies except offshore wind, geothermal, and hydropower, where there is inherently greater construction risk.

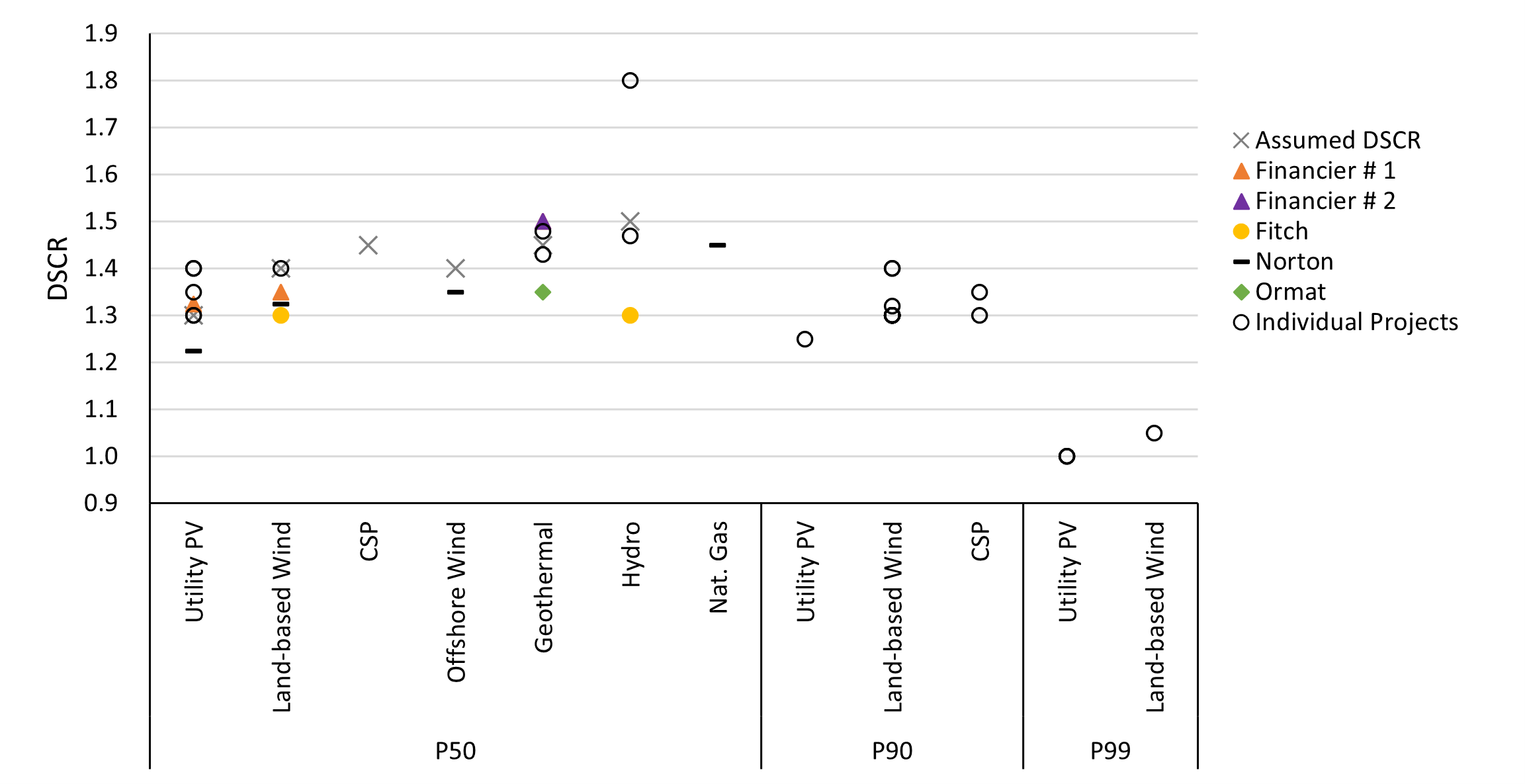

The following figure shows collected data on the DSCRs for renewable energy assets and the assumed DSCR for the 2023 ATB analysis. P50 represents an average-level of energy production (or 50% likelihood to generate that much or more electricity), and P99 represents a production level that the project has a 99% chance of exceeding. The assumed P50 DSCR, per technology, is based on collected data of P50 DSCR and is influenced by the difference in average DSCRs between technologies in P90 and P99 scenarios, as well as collected DSCRs from ratings agencies for stress modeling cases (not shown).

Sources: (Norton Rose Fulbright, 2019)(Norton Rose Fulbright, 2023), , (Credit Agricole Securities, 2018a), (Credit Agricole Securities, 2018b), (Ormat Technologies, 2023), (Fitch Ratings, 2019)and NLR telephonic interviews with two unnamed financiers on January 31, 2020 and March 20, 2020

Similar to the cost of equity, technologies with perceived greater operating risk from the financial community tend to have higher DSCRs. This is validated by a recent report from Fitch Ratings (Crowell, 2020), which stated, "More than a decade of analysis shows that solar resources are consistently more stable and predictable than wind, resulting in less volatile revenues and generally higher ratings." As another example, land-based and offshore wind are reported to have the same DSCR, because the greater operation and maintenance uncertainty of offshore wind (i.e., maintaining an asset in the ocean) is counterbalanced by having more certainty in wind speed than land-based wind (Norton Rose Fulbright, 2019).

The following table summarizes financial assumptions by technology during the project's operation.

| Operation | Construction | ||||||

|---|---|---|---|---|---|---|---|

| Technology | Electricity Sales | After-Tax Equity Returns | Interest Rate of Term Debt | DSCR | After-Tax Equity Returns | Interest Rate of Construction Debt | Leverage |

| Utility PV and utility PV+battery | PPA | 8.75% | 7.0% | 1.30 | 9.5% | 6.5% | 80% |

| Residential and commercial PV | PPA | 9.75% | 7.0% | 1.30 | 10.5% | 6.5% | 80% |

| CSP | PPA | 11.0% | 7.0% | 1.45 | 12.0% | 6.5% | 80% |

| Land-based wind | PPA | 10.0% | 7.0% | 1.40 | 11.0% | 6.5% | 80% |

| Offshore wind | PPA | 11.0% | 7.0% | 1.40 | 12.0% | 7.0% | 80% |

| Distributed wind | PPA | 10.0% | 7.0% | 1.40 | 11.0% | 6.5% | 80% |

| Geothermal | PPA | 11.0% | 7.0% | 1.45 | Predrilling: 15% Post-drilling: 10% | 7.0% | Predrilling: 0% Post-drilling: 75% |

| Hydropower | PPA | 11.0% | 7.0% | 1.50 | 12.0% | 7.0% | 80% |

| Pumped storage hydropower | PPA | 11.0% | 7.0% | 1.50 | 12.0% | 7.0% | 80% |

| Natural gas | Quasi-merchant | 11.0% | 8.0% | 1.45 | 10.0% | 8.0% | 55% |

Using the above assumptions, we run the System Advisor Model's (SAM) leveraged partnership-flip cash flow model to calculate debt fractions. We set the internal rate of return and real discount rate equal to the nominal and real rates of return on equity (respectively), and the flip target year to Year 10 to match the expiration of the production tax credit. We assume the tax equity investor (1) provides 90% of the pre-flip equity and (2) receives 90% of the tax benefits and project cash. After the flip year, the tax investor receives 10% of the project cash. The resulting debt fractions are viewable above in "Financial parameters by technology and financial assumptions case."

Another important factor in determining the financial structure for a renewable energy project is the level of tax credits, if any. Below is a summary of the tax credits assumed in analysis for the 2023 ATB. We assume eligible projects will use the full duration of the "safe harbor" window in order to receive the maximum tax credit level, which is 4 years for onshore geothermal, hydropower, solar, and onshore wind projects, and 10 years for offshore wind. We assume the tax credits will begin to phase out in 2038, based on when the Mid-case of the National Laboratory of the Rockies's 2022 Standard Scenarios reaches the Inflation Reduction Act of 2022's emissions reduction targets (Gagnon et al., 2022). Most technologies installed in 2025 or later have the option of choosing the production tax credit or the investment tax credit; we choose the credit that minimizes LCOE for the representative plant, as shown below.

Assumptions include that labor requirements are met, but bonus credits are not included (The White House, 2022).

Based on these assumptions, as well as CAPEX, fixed operation and maintenance, variable operation and maintenance, capacity factor, and fuel costs, we run financial models to calculate a technology's leverage as governed by the minimum DSCR, assuming a debt amortization schedule of 18 years (which is a common debt amortization period for U.S. renewable energy projects, even if the term of debt is shorter) (Norton Rose Fulbright, 2023)(Martin, 2019). In general, leverage only varies significantly over time due to changes to interest rate, tax rate, and the amount of tax credits received, but because of CAPEX, fixed operation and maintenance, or capacity factor. For this reason, the same leverage can be used by a technology for different resource classes. The exception to this is projects receiving the production tax credit (i.e., land-based wind); because production tax credit value represents a different percentage of project costs for different resource classes, leverage changes. A similar, but smaller, change can also be seen for natural gas, depending on fuel price. Because we cannot input different leverage values for different resource classes in the ATB (because of current programming constraints), we use the leverage for Wind Speed Class 4-Technology 1, because it is currently the most common resource level for land-based wind systems. It is important to keep in mind that these relationships occur because the financial model (SAM) solves for return on equity, which will determine the electricity rate needed to achieve specific economic returns. If the financial models were to solve for economic returns, given an assumed electricity rate, the leverage on projects with higher capacity factors (all other things being equal) would be greater than those with lower capacity factors. See the parameter value summary above for the calculated leverages for the ATB.

In the R&D Only cases, leverage between renewable energy technologies only varies from 69% to 74%. A certain degree of variability in leverage exists between technologies because of differences in capacity factors, return on equity, DSCR, and interest rates. In the Market + Policies Case, the leverage on technologies with tax credits decreases as costs decline and then increases again when the tax credits phase out. Using these values, we calculate WACC for the different technologies, which is summarized in the parameter value summary above.

In the R&D Only Case, the nominal after-tax WACC varies from 6.14% to 7% for renewable energy technologies, and it is 8.2% for natural gas. A certain degree of variability in WACC exists because of underlying construction and operation risks, as well as contract risk for natural gas. In the Market + Policies Case, the WACC on technologies with tax credits decreases as these credits phase out.

It is important to remember that financing costs are one piece of the overall cost competitiveness of a project. Though projects receiving tax credits might have lower leverage, and thus a higher WACC, they benefit from the tax credits, which overall, reduce the LCOE. Likewise, Wind Speed Class 1 would have a higher WACC than Wind Speed Class 10, but that is because the cost of energy of Wind Speed Class 10 is much higher, which can support a higher modeled debt fraction. Natural gas has the highest calculated leverage, but it still has the highest WACC because of the increased cost of debt and equity (in part because it is the only technology analyzed in the ATB that does not have fully contracted cash flows).

Looking forward, we do not assume a change to the cost of equity or DSCR because many factors might influence these variables. For example, political, corporate, or regulatory changes might push the cost of equity and DSCR higher or lower (e.g., impact the ability to get long-term contracted cash flows). The renewable energy industry is actively working to continue to remove the risk and uncertainty associated with these technologies and to provide more-consistent expectations of electricity production (e.g., lower failure rates, better energy production forecasting, and more-consistent resource availability through higher wind towers). However, renewable energy assets already receive favorable financing because of their ability to receive long-term fixed electricity contracts, the relative demand for green investments, and the lower-risk benefits of tax credits. Which of these factors will change in the future is unclear. Utilities might stop offering long-term contracts or project owners might be exposed to more curtailment risk. On the other hand, with many states pushing for more carbon-free electricity, utilities might see these long-term contracts as low-cost options to satisfying these requirements; without long-term contracts, utilities might incur higher costs because of the increase in financing costs caused by shorter contracts.

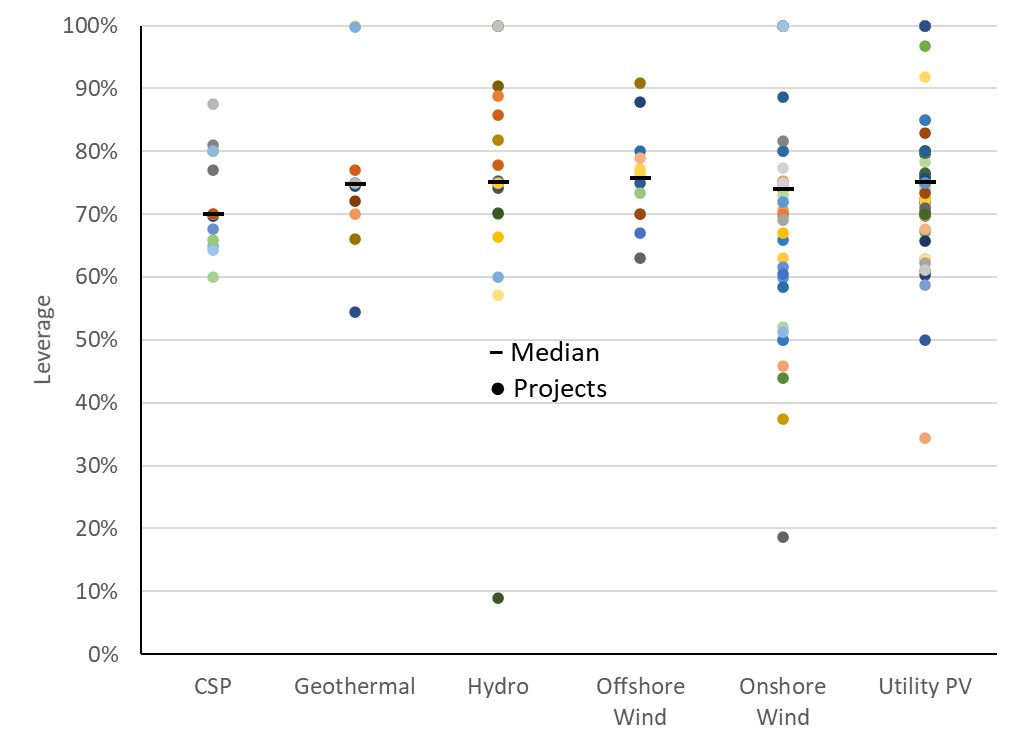

Additionally, although curtailment and value loss could be more of an issue in the future as renewable energy assets make up a larger share of the total electricity generation mix, many active mitigation strategies are being developed, both by individual actors (e.g., pairing storage with renewable energy electric generation) and through larger, grid-level activities. And, although lower average DSCR, through lower risk perception, might support higher project leverage, this benefit might be counteracted by higher equity returns achieved through higher leverage. Historically, many international renewable energy projects have had slightly higher leverage and higher equity returns. For the 2020 ATB, we collected data from 174 global renewable energy projects.

Sources: (BNEF, forthcoming), (World Bank, 2014), (New Energy Update, 2019), (Thompson Reuters, 2018), (Thompson Reuters, 2019), and an NLR personal communication, 2020

Although leverage varies dramatically among individual projects, the median leverage is generally around 75%, and there are no clear differences between technologies. And the differences are lessened when removing the projects that receive more than 80% financing through debt, with the median dropping to around 70% for all technologies, which roughly matches the approximate leverage calculated for technologies in the 2023 ATB. Many of these highly leveraged projects received government, or quasi-government (e.g., World Bank), assistance in the form of nonmarket loan terms (e.g., 30-year terms), loan guarantees, or favorable credit guidelines. Many also received higher returns than projects in the United States, in the mid-teens, which allowed for even greater leverage, as higher equity returns are achieved by higher-priced electricity or other revenue streams, which allow more debt for the same DSCR. This is not to say research on risk reduction is not a critical part of providing favorable renewable energy project economics but only that reductions in perceived risk will not necessarily lower the absolute cost of financing from current levels—rather it will likely keep rates as low as the market will bear. Reducing risk also allows for increased deployment by opening markets or projects that would have otherwise been too risky.

References

The following references are specific to this page; for all references in this ATB, see References.